Weekly Report 2024 (Monday) – Gladstone Associates Provident, Controlled Disinflation, Rumours of Cuts and Market Analysis

Gladstone Associates Provident is pleased to present its weekly analysis of global financial markets. In this report, we provide a detailed overview of the key events that have affected markets this week.

Global financial markets closed the week with gains, highlighted by strength in Europe and an S&P 500 at its highest level of the year. The US labour market led the way, showing strength amid a gradual cooling. In emerging markets, China struggled after Moody’s downgrade. Japan faces a strong yen and falling US yields as it prepares to leave the YCC.

“This week commodities traded higher, with a cumulative gain of +1.06% according to the Bloomberg Commodity Index. The dollar depreciated significantly (-1.40%WTD). Meanwhile, in the case of crude oil, Brent rose to $76.55 (+0.94%), while WTI traded in the same direction, +0.28% and closing at $71.43.”

FOMC Meeting: Pivot, Episode 1

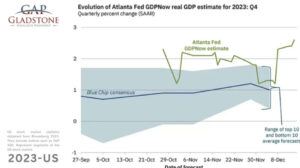

The Federal Reserve, in line with market expectations, maintained the benchmark interest rate within the 5.25%-5.50% range. The latest statement acknowledged a slowdown in economic activity compared to the third quarter, with moderating labour market dynamics. While job creation remains robust, inflation has decreased over the past year but remains elevated.

Key Points:

- Economic Outlook: The Fed expressed concern about the impact of tightening financial and credit conditions on inflation, employment, and economic activity. Despite the statement, there was no explicit acknowledgment of the recent easing of financial conditions.

- Hawkish Tone Adjustment: A subtle shift in the statement softened the previous hawkish bias, suggesting that the Fed sees itself nearing or at the end of the rate hike cycle.

- Economic Projections: Economic growth for 2023 was revised to 2.6%, and employment projections remained stable. Notably, inflation estimates saw a significant cut, indicating the Fed’s confidence in addressing inflationary pressures.

- Dot Plot Adjustment: The dot plot lowered interest rate projections for 2023 and, more significantly, for 2024, signaling a potential shift towards rate cuts next year.

- Powell’s Stance: Fed Chair Powell, in the press conference, ruled out further hikes and hinted at considering rate cuts. This marked a notable departure from his stance just a month earlier.

Concerns and Analysis:

- Financial Conditions Oversight: The Fed’s reluctance to acknowledge the easing of financial conditions surprised observers, as this phenomenon could impact growth forecasts. Powell did not explicitly address this shift during the press conference.

- GDP Growth Projection: Despite potential positive effects on aggregate demand from looser conditions, the Fed lowered the GDP growth projection for 2024, raising questions about the alignment of growth and inflation objectives.

Overall, what surprised us most about Powell in particular, and the FOMC in general, was their reluctance to acknowledge the remarkable easing of financial conditions in recent weeks (and which has deepened since this last Fed meeting). Indeed, even if they did not acknowledge this phenomenon, they could have implicitly reflected it, for instance by raising growth forecasts for next year given the impact of looser conditions on aggregate demand. Nor did they do the latter, in fact, they lowered the GDP growth projection for 2024 to 1.4% (from 1.5% previously). At the press conference, Powell had more than one opportunity to oppose the easing of financial conditions, but chose not to do so, implying that it does not compromise the FOMC’s objectives. In doing so, he went completely against the grain of his previous interventions. The question now is whether GDP growth of, say, 2% (i.e. significantly above the consensus 1.2%/Fed 1.4%) will allow inflation to eventually converge to 2%.

Inflation – the last mile?

Global equities closed the week with overall gains, showcasing strength in Europe and a slightly less robust performance in the US, where the S&P 500 achieved a six-week consecutive rise. The standout of the week was the resilient US labor market, indicating stability amid a gradual cooling trend that extended into November, instilling renewed optimism for a soft landing.

However, emerging markets faced mediocre performance, particularly impacted by China’s downgrade by Moody’s. In Japan, the strength of the yen weighed on equity, compounded by declining yields in the US as the country prepared to exit Yield Curve Control (YCC).

Reviewing release data, notable highlights include a decline in energy prices (-2.3% m/m), continuing the reversal from the August-September shock. Food inflation followed the established trend with a modest increase (+0.2% m/m). Core inflation aligned with expectations at +0.28% m/m, accelerating from the previous month, while the year-on-year figure receded more slowly to +4.0% y/y, in line with consensus.

Breaking down core inflation, services gained traction at +0.47% m/m (vs +0.34% in October). The “super core” services measure, crucial for last month’s positive inflation dynamics, rebounded, rising from +0.22% m/m in October to +0.44% m/m in November. Categories such as health care services contributed to “super core” inflation, rising at +0.60% m/m, the highest pace in 14 months. In shelter, inflation accelerated this month (+0.45% m/m vs +0.33% m/m in October), with stable rents (+0.48% m/m) and an increase in OER (+0.50% m/m) compared to the previous month.

This week was a key week, marked by US inflation data and central bank meetings. The Federal Reserve surprised by suggesting rate cuts next year, supporting Wall Street’s optimistic view. Despite a more hawkish tone from some European central banks, the rally in financial assets continued. Equity indices were little changed, with real estate and materials posting strong gains.

European Central Bank & Bank of England:

The ECB Governing Council left policy rates unchanged, in line with market expectations. It broadly left the guidance unchanged, but understood that the current level of rates is crucial for reducing inflation and that rates “will be set at sufficiently restrictive levels for as long as necessary”. During the press conference, President Lagarde stressed that the Governing Council would continue to pursue a “data-dependent” rather than a “time-dependent” approach. She also pointed out that rate cuts had not been discussed “at all” and that “now was not the time to let our guard down”. Note the contrast between these statements and Powell’s conference a few days ago. In general, for our part, we have always praised Lagarde’s coherence in her management and how she has faced the challenge of high inflation, in contrast to a Powell who on more than one occasion adopted rather erratic positions. We reaffirm this conviction.

“An interesting point, obviously, was the ECB staff projections, which reduced GDP growth by 0.1 and 0.2 percentage point for 2023 and 2024 respectively. On the price side, the estimates for headline and core inflation stand out, which were reduced by 0.5 and 0.2 percentage points for 2024, respectively. For 2025, headline inflation remained unchanged at 2.1%, while core inflation was revised up by 0.1 percentage point to 2.3%. Finally, headline and core inflation were projected at 1.9% and 2.1% in 2026, respectively.”

Our view Let’s talk about cutbacks…

In recent developments, the Federal Reserve’s stance on inflation and monetary policy has seen unexpected shifts, impacting market expectations. Initially, the Fed’s view appeared more restrictive than the market’s anticipation of rate cuts. Surprisingly, the Fed later aligned itself with market sentiment, citing evidence of its victory over inflation.

Key Points:

Inflation Dynamics: The Fed claims success in curbing inflation, citing the ongoing disinflation of goods as pandemic-related bottlenecks dissipate. Housing indicators also suggest optimistic price dynamics, crucial for the Consumer Price Index (CPI).

- Labour Market Rebalancing: The labour market shows signs of supply and demand rebalancing. However, the Fed acknowledges the challenge of relying solely on employment figures for monetary policy decisions.

- Real Interest Rate Hikes: Falling inflation itself leads to real interest rate hikes, minimizing the need for the Fed to raise rates to achieve monetary tightening.

- Lower Interest Rate Expectations: The success in controlling inflation is expected to translate into lower interest rate expectations for the upcoming year. This aligns with the shift from 8% headline inflation to levels closer to 3%.

- Role of Fiscal Policy: Emphasizes the significant role of fiscal policy, currently expansively deployed in the United States, complicating the Fed’s task. Advocates for a collaborative effort between the Fed and Treasury in managing public spending.

Concerns and Considerations:

- Communication Challenges: Expresses skepticism about the Fed’s communication approach, highlighting the inconsistency in Chairman Powell’s statements and the subsequent need for officials to clarify or qualify guidance.

- Market Reaction: Criticizes the Fed’s apparent lack of understanding regarding the market’s reaction to hawkish or dovish statements, emphasizing the need for a more predictable approach.

- Financial Conditions Impact: Questions whether the Fed fully grasps the recent loosening of financial conditions and its potential impact on economic activity, especially considering earlier indications of a solid third quarter.

“If the growth momentum is extended further in time, we could have a rebound in prices and we see the market as ready for this. Because (and this is absolutely key) we cannot confuse “touching for a moment” 2% inflation with “sustainably and durably reaching the 2% target. Anyway, we will have room to reflect on this in 2024, a year that markets are likely to start quite optimistically and where we, despite this year’s phenomenal rally, even with a cautious approach, believe that it presents interesting opportunities both at the equity level and in fixed income in general. We will see how it turns out.”

International summary:

UNITED STATES

In the United States, apart from labour data, there was little in the way of economic data. Of note were preliminary figures from the University of Michigan, which indicated an improvement in consumer confidence. Consumer inflation expectations fell, while the services ISM showed signs of expansion. The treasury market experienced some volatility, with the curve flattening towards the end of the week.

In addition to inflation, this week we highlight retail sales figures, which rose 0.3% m/m in November, with solid gains in ex-store retailers and in restaurants and bars more than offsetting the effects of lower gasoline prices. Moreover, the figures far exceeded expectations (consensus -0.2% m/m), which had anticipated a more significant drag from gasoline prices and somewhat weaker Christmas sales. The figures excluding gasoline (-2.9% m/m) and autos were very solid +0.6% m/m, although it is clear that the end of the year is usually a high point in this indicator (due to seasonal issues).

Apart from inflation, retail sales rose in November, beating expectations. New jobless claims declined, and preliminary PMIs suggest a mixed 4Q23. The labour market and retail sales showed strength, supporting optimism.

EUROPA

Euro zone retail sales showed some stability, with a rise in Spain and a decline in German industrial production. Euro zone PMIs improved slightly, but remain in contractionary territory. The euro zone economy contracted slightly in the third quarter, pressured by inventory changes and weakening economic sentiment.

The first warning this week was given by the fall in industrial production (-0.7% m/m in October), and the PMIs confirmed the trend, at the Eurozone level the manufacturing PMI (p) remained stable, but in broadly contractionary territory (44.2) when a recovery was expected, while, in the services sector, there was a more pronounced fall (from 48.7 in November to 48.1 in December), also higher than expected. On the other hand, the price components of the PMIs would point to a faster disinflation than estimated by the ECB, which is positive, if we ignore that it is probably the recession that will end up pushing prices even further downwards. Something like the peace of the graveyards.

With a worrying preliminary PMI for December, industrial production fell in October. The price components of the PMIs indicate faster disinflation than the ECB estimates.

UNITED KINGDOM

In the UK, services and composite PMIs improved, moving back into expansionary territory. At the wage level, earnings excluding bonuses showed growth of 7.3%, slightly below expectations. Other economic indicators were mostly weak.

Revenues excluding bonuses rose 7.3% y-o-y in the three months to October, compared to a growth rate of 7.8% y-o-y in the three months to September (with bonuses the figures were 7.2% y-o-y and 7.8% y-o-y respectively), both below consensus expectations. As for the preliminary PMIs, unlike in Europe, in the UK the services sector continues to gain traction, 52.7 the preliminary figure (vs. 51 in the consensus and 50.9 in the November figure). Solid, but only that, manufacturing deepened its contraction (46.4) and all other GDP figures this week, (-0.3% m/m in October), among others, were generally weak.

CHINA

This time, consumer prices fell for the second month in a row, a deepening bout of deflation that shows Beijing’s efforts to revive growth may not be working (we have been warning about this for some time). In particular, consumer prices fell by 0.5% in November (versus -0.2% in the consensus) from a year earlier, a steeper drop than October’s -0.2%. Meanwhile, amid falling global oil prices and weak industrial demand, PPI deflation deteriorated faster than expected in November, with the index falling 3% y-o-y after falling 2.6% in October (it also fell more than the Bloomberg consensus of -2.8%).

On the activity side, data were mixed across the board, with industrial production rising 6.6% y-o-y in November (Bloomberg consensus: +5.7% y-o-y), gaining momentum from +4.6% y-o-y in October. Fixed asset investment followed the same trend and grew by 2.9% y-o-y in November (consensus: +3.0% y-o-y). Finally, retail sales rose strongly by 10.1% y-o-y in November, but fell short of expectations (consensus: +12.5% y-o-y). Given the persistent obstacles to growth stemming from the housing crisis and the still very weak confidence, the recovery will continue to depend on what the central government and its stimulus policies do.

Caixin’s services PMI rose, but the lack of relevant data left room to highlight exports, which rose in November after six months of declines. Exports benefited from manufacturers’ price cutting strategy. Imports, on the other hand, continued to show weakness.

Fixed Income

In the fixed income market, the US Treasury curve experienced notable volatility, marked by significant intraday movements. Argentina displayed positive resilience in spreads, while Brazil and Gol faced some pressure. Investors are advised to maintain an active focus on credits from Brazil, Argentina, Colombia, Costa Rica, Dominican Republic, and Bahamas.

Following a robust rally, yields are anticipated to consolidate around 4.20-4.30%, with stable spreads, particularly noteworthy in Argentina. The volatility in the US Treasury curve was a focal point during what is deemed one of the most crucial weeks of the year for fixed income. Yields experienced a broad-based decline across the curve, with UST10-30y rates dropping by as much as 29-30 basis points, and UST2-3y falling by 27-33 basis points.

Contrary to expectations for stability after the strong November rally, Powell’s shift away from “higher for longer” and the possibility of rate cuts in 2024 altered the scenario, aligning with market predictions. At the credit level, there was a significant compression of spreads, especially in riskier credit segments like US High Yield, which saw a remarkable -26 bps in a phenomenal week, particularly for CCCs.

CoCos followed a similar trend. In US Investment Grade (IG), the compression was more moderate, but thanks to the rate cut, it closed the week with greater gains than US High Yield and Emerging Markets. In Latin America (LATAM), attention is drawn to the improved performance of ARGENT, despite closing the week with losses, indicating potential profit-taking while awaiting new measures. On the corporate level, BRASKM lost its expected IG status, presenting an opportunity to position in one of the region’s solid companies. Active engagement continues, especially in BRAZIL, ARGENT, COSTAR, DOMREP, and BAHAMAS, among others.

“This analysis provides detailed insight into the performance of financial markets and the global economy, offering readers key information to make informed decisions in a dynamic environment.”

Gladstone Associates Provident Group

For more information:

SUBSCRIBE TO OUR WEEKLY REPORTS CHANNEL: