Weekly Report 2024 (JANUARY) – Gladstone Associates Provident

Introduction to Gladstone News – 2024

Over the course of 2023, the financial market demonstrated remarkable resilience, facing a number of challenges such as the SVB crisis, the Credit Suisse bankruptcy and geopolitical conflicts such as the Israel-Hamas war. Despite these obstacles, the year proved to be extremely successful for investors.

At the beginning of 2023, economic expectations were gloomy, anticipating a scenario of low growth or even recession. However, despite the upward interest rate cycle, the global economy exhibited solid resilience, with the US and Europe in particular standing out. China, although experiencing a reopening, failed to meet economic performance expectations.

In inflationary terms, inflation dynamics also evolved favourably, moving from 8%-9% year-on-year to ranges of 4%-5%. Although price convergence slowed, it is now close to 3%, with the 2% target on the horizon, generating cautious optimism.

However, this success did not come without costs. The “sacrifice rate”, which measures the cost in terms of employment and GDP associated with defeating inflation, is one factor to consider. With unemployment below 4% and economic activity still healthy, central banks are seeking to avoid a recession, although the second half of the “game” has yet to be played, requiring caution.

POSITIONING FOR 2024

For the current year, the surprisingly effective inflation control suggests a smooth path for the US economy, prompting comparisons with the rate adjustment of the 1990s. Although the current 0-0.25% increase to 5.25-5.50% was more drastic, the expectation of investors is a positive scenario, anticipating a “Roaring Twenties” style economic resurgence. Factors such as infrastructure investments and technologies such as artificial intelligence support this optimistic view, despite the global risks ahead. Caution remains key in the face of economic uncertainty.

Overall, what surprised us most about Powell in particular, and the FOMC in general, was their reluctance to acknowledge the remarkable easing of financial conditions in recent weeks (and which has deepened since this last Fed meeting). Indeed, even if they did not acknowledge this phenomenon, they could have implicitly reflected it, for instance by raising growth forecasts for next year, given the impact of looser conditions on aggregate demand. They did not do the latter either, in fact, they lowered the GDP growth projection for 2024 to 1.4% (from 1.5% previously). At the press conference, Powell had more than one opportunity to oppose the easing of financial conditions, but chose not to do so, implying that it does not compromise the FOMC’s objectives. In doing so, he went completely against the grain of his previous interventions. The question now is whether GDP growth of, say, 2% (i.e. significantly above the consensus 1.2%/Fed 1.4%) will allow inflation to eventually converge to 2%.

A BRIEF RECAP OF 2023

In 2023, investors experienced a shift from initial pessimism to euphoria, marking a contrast to the widespread declines of 2022. While initial expectations pointed to a recession, defensive positions focused on value sectors and high quality fixed income credits. Gladstone’s outlook, presented in “Outlook 2023”, was notable for recommending an overweight in fixed income and an optimistic view on equity, with a focus on growth assets. Despite the lack of recession, the strategy was successful in equity, while high yield credit stood out in fixed income, in line with the general rally in risk assets.

Overall, beyond macroeconomic developments, the most characteristic feature of the past year was the extreme volatility in fixed income markets, which was an unmistakable source of instability that spilled over into equity markets. Here, the Fed, far from helping to “smooth” this phenomenon, accentuated it with its “back and forth” in terms of communication. In addition, fiscal policy made its appearance, with investors questioning the repayment capacity of US debt, given the huge budget deficits of the federal government, which in turn required a large issuance of treasuries that, at times, the market was reluctant to validate.

“Projections 2024 and Beyond: Deciphering Secular Change”

Gladstone News Summary – Economic Outlook 2024

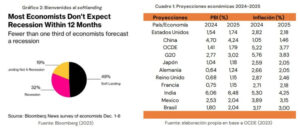

Projections for the coming year indicate more moderate global economic growth in 2024 compared to the previous year. The United States and China are experiencing a cooling in their rates of expansion, although consumer strength in the US and stimulus policies in China have helped sustain growth, defying expectations of a US recession that prevailed a year ago.

Despite signs of weakness in some indicators, the US shows no clear signs of recession, consolidating its position as a leader in global economic growth. In contrast, China faces demand challenges, evidenced by monthly data reflecting a lack of dynamism in the private sector, including consumer spending, real estate and private investment. Recent figures confirm a persistent trend of slowing retail sales, services spending and stagnation in the housing market through 2023.

“An interesting point, obviously, was the ECB staff projections, which reduced GDP growth by 0.1 and 0.2 percentage point for 2023 and 2024 respectively. On the price side, the estimates for headline and core inflation stand out, which were reduced by 0.5 and 0.2 percentage points for 2024, respectively. For 2025, headline inflation remained unchanged at 2.1%, while core inflation was revised up by 0.1 percentage point to 2.3%. Finally, headline and core inflation were projected at 1.9% and 2.1% in 2026, respectively.”

China faces economic challenges with its real estate sector in recession and private investment stagnating. Despite government measures, weakness persists, reflecting structural problems. The projection of inflation below 2% points to continued difficulties.

In Europe, after a 2023 with moderate growth, a mild upturn is expected. Although the European Central Bank has completed rate hikes, uncertainty about the start of rate cuts persists due to inflation. Despite a strong labour market and income recovery, scepticism about optimistic projections remains, evidenced by widening credit spreads in Europe versus the US, indicating growing risks and fears of recession, accentuated by the ECB’s hawkish stance.

The great disinflation?

Contrary to pessimistic forecasts, global inflation continues to decline. Looking at a broad set of economies, excluding Japan and other emerging countries that anticipated rate hikes, core inflation recorded an annualised increase of 2.2% in the last three months and just 1.3% in November. In the United States, core PCE inflation is projected to reach 2.5 per cent annualised in February 2024, before falling to around 2 per cent in May.

In Europe, monetary policy had a quick and efficient impact, reflected in inflation of 2.9% p.a. in December. Meanwhile, China is experiencing a deflationary situation, exporting this phenomenon to the rest of the world, which makes it easier for central banks to manage. In many emerging countries, such as Latin America, rapid responses by central banks have led to a rapid decline in inflation, resulting in rate cuts in several cases.

The central question focuses on whether disinflation in services will precede reflation in goods, pointing to certain “red flags” such as the recent increase in container rates.

EMERGING FROM THE “TYRANNY OF SHORT-TERMISM”: STRUCTURAL CHANGES IN THE GLOBAL ECONOMY

Global developments, driven by events such as the pandemic and the war in Ukraine, challenge the post-Cold War model of development and governance based on the principles of the “Washington Consensus”. In this new scenario, several governments are challenging its fundamental pillars, such as fiscal discipline, financial liberalisation and globalisation.

“In response to an ever-changing global environment, many countries are seeking to adjust their priorities towards more sustainable and national security-focused development models. This approach, while sensible, poses considerable challenges, such as high costs and intensive competition for key inputs. The war in Ukraine and trade tensions between the US and China exemplify this inflationary scenario, driving the resurgence of industrial policies and greater government intervention in the economy. As a result, corporate profitability will increasingly depend on policy decisions, creating an environment where some companies are designated as “winners” and others as “losers”. This shift also implies an increase in public spending, creating additional pressures on the sustainability of public finances. We anticipate that the intersection between government decisions and business performance will become increasingly frequent in this complex global economic and political landscape.”

Jake Sullivan, Biden’s national security adviser, points to emerging challenges:

- Deterioration of the US industrial base, with supply chains shifting overseas.

- Uneven economic growth, favouring sectors such as finance over semiconductors and infrastructure.

- Unfulfilled economic integration risks, with a less peaceful global order than expected.

- Challenges of economic interdependence and vulnerabilities in critical supply chains.

- Climate crisis and the need for an efficient energy transition.

- Rising inequality and its impact on democracies.

These challenges signal a transition towards greater economic fragmentation and protectionism, prioritising resilience over efficiency in supply chains. In addition, it highlights the shift towards an economy where supply-side scarcity drives global growth, marking a significant structural change.

International summary:

UNITED STATES

In 2023, the US equity market experienced a rotation from value to growth sectors, led by large technology companies. Although the year started with volatility in technology stocks, the current outlook suggests an opportunity in value sectors. The thesis is based on correcting the market imbalance and diversifying beyond a few companies.

For 2024, a rotation into value sectors is foreseen, with an emphasis on Utilities and Consumer Staples due to their defensive nature and attractive valuations. Interest is also shown in Industrials, supported by reasonable valuations and a favourable political and economic backdrop.

Caution is exercised towards sectors such as Energy, Materials and Financials, considered more vulnerable to market changes. Global exposure is tilted towards the value style, while a pause in technology stocks is anticipated, especially in Consumer Discretionary and Communications Services.

In conclusion, the strategy tactically targets value and small caps, recognising the importance of maintaining a medium/long term growth bias. Consolidation in technology stocks is expected after the initial artificial intelligence boom, but is projected to be short-lived.

United States: More expensive, but resilient

As already mentioned, in government bonds, at the developed world level, the US remains the best choice, with the middle and long end of the curve (10-30yr) as our preferred segment. As far as corporate bonds are concerned, US IG credit continues to benefit from the positive ratings momentum after 2023, where total upgrade volumes far outweighed downgrades. Among the rising stars, we highlight the upgrade of Ford, the largest issuer in the US HY market, upgraded to IG towards the end of the year. Looking ahead to this year, we expect credit spreads to continue to trade near the lower end of their long term range. With below trend growth in the US, high rates and credit fundamentals having peaked and we expect higher defaults in 2024 compared to 2023, but at controlled levels. This implies a possible widening of spreads but slight in the case of IG paper (oscillating in the 100-120 bps range) and wider in HY credit, which despite offering higher absolute YTW, today trades very tight when compared to the higher quality segment (see chart 33), hence we continue to favour US IG bonds over US HY.

Regarding US IG technicals, we believe that they will be even more favourable this year (unlike the HY market). On the one hand, we expect gross supply to increase marginally in 2024, as companies naturally respond to lower funding costs by coming to market to take on debt. However, a fall in net supply is likely as firms have little incentive to increase their leverage as debt maturities accelerate. On the demand side, the outlook is also favourable this year. While the recent fall in rates and spreads eroded the peak of carry, current yield levels are more than attractive (as opposed to spreads) at least by the standards of the post-global financial crisis period (see figure 34). On top of this, cash will start to lose its edge as the Fed and ECB start to cut. In addition, it is expected that the low allocation percentages in US IG by insurance companies and pension funds may continue to increase.

Emerging Markets:

After an average return of 9.03% in 2023, emerging markets (EM) focus on the US monetary cycle as this year begins. Uncertainty over the economic landing drives idiosyncratic factors such as earnings, defaults and growth and inflation. Despite a moderation in macro growth, resilience is sustained by high savings and the absence of a private sector debt overhang. Asia is projected to recover, while Latin America slows. Inflation returns to target zones, but rates remain tight. The crucial election calendar in India, South Africa, Romania and Mexico is highlighted, with implications for macro and market prospects, as well as elections in “frontier” markets and amid debt restructurings.

On credit fundamentals, the challenge posed by high interest rates and lower GDP growth to debt metrics is acknowledged, but deterioration is expected to be contained in 2024. Debt refinancing at higher rates is seen as a gradual process. At the country level, fiscal deficits persist, but GDP remains relatively high. Corporate EM companies will experience a modest deterioration, projecting a 4% corporate default rate in 2024. The figures indicate a strong position for EM companies, with conservative leverage compared to their US counterparts.

Finally, technical indicators have challenged EMs, but a reversal is anticipated in 2024, especially in the second half, closing with positive flows. Net local bond issuance is expected to increase and a favourable scenario for EM sovereign debt. Net local bond issuance in EM-ex China is projected at $608bn (+28% YoY), while for hard currency sovereign debt it remains in line with 2023. EM corporate gross supply is forecast at $244bn, marking the third consecutive year below average, an additional favourable factor.

EUROPE

By 2024 after a positive performance in 2023. Macroeconomic resilience is observed, weakness in the Eurozone persists. Despite improvements in private balance sheets and a strong labour market, the region faces structural challenges, such as trade deficits and lack of reforms. Although Europe is more affordable and less concentrated than the US, limited earnings and a lack of technological innovation raise doubts about its future performance. The focus is on defensive sectors, with Switzerland standing out as an exception.

In short, Europe is positioned as one of the most affordable, less concentrated and its investor positioning is significantly lighter compared to the US, so under normal conditions it would offer better prospects for returns. Where is the flaw? In the meagre earnings growth, it is a familiar story that explains the long underperformance of European equities relative to US equities. We knew it last year, we know it now. What changed then? On the one hand, the rebound has already happened and on the other hand the emergence of AI. Just when we thought that without the “Fed put” it would be difficult for the US to maintain its leadership, the Fed managed to pull a new rabbit out of the hat.

With this driver, the productivity of the American economy, its companies and workers gets a new boost, which will translate into higher profits for companies and their shareholders. Could the old continent get on board this revolution? Difficult, the region lags far behind the United States in terms of R&D spending (graph 23), the latter being a much more innovative, competitive economy and an undisputed leader in the sector at the heart of this revolution, the technology sector. In contrast, Europe is a value market, cyclical and highly exposed to the vulnerability of national economies. While it is true that today the Eurozone economies look healthier (we also highlight the improved fiscal balance compared to the US) and even considering the large discount Europe offers vs. the US (graph 24), today we are UW at the regional level. At a general level, with inflation falling, real wages recovering and growth still positive, the consensus is quite optimistic about the future of the global economy. We are hesitant about this excessive optimism, while acknowledging the arguments in favour of a global soft landing, our balance sheet includes several material risks to be taken into account. Given the risk, and in the context of a global positioning that generally favours value, cyclicals and small caps, we prefer to focus on the markets where we have the most conviction.

Emerging Markets:

Gladstone presents an optimistic outlook for emerging markets (EM) in 2024, highlighting a turn in the cycle supported by factors such as an easing dollar and the anticipation of a soft economic landing. While valuations are not particularly cheap, the estimated earnings growth for the MSCI Emerging Markets index suggests a strong year. There are several factors that would enable us to expect decent returns from this asset class. For one, a downward pressure on the dollar is expected this year in line with the Fed’s monetary easing cycle. Along with this, remember that emerging market central banks started the rate hike cycle almost a year earlier than the developed world, so they have more flexibility to manage their monetary policy. From a macroeconomic point of view, the best scenario for EM is soft-landing (our base case) as an overheated US economy would push rates and the dollar higher. Similarly, a recession in the US is obviously not desirable either. In terms of valuations, these do not look particularly cheap with a PE around 12x, more or less in line with the historical average, but it is worth noting that the dispersion is huge, from 21x in India to 6x in Colombia. From an earnings perspective, it should be remembered that MSCI EM EPS has been stable for over a decade, with an average annualised growth of +0.5% from 2009 to date, and the result has been a virtually flat index. Another “lost decade”. However, 2024 is positioned to be a pretty good year, leading in terms of earnings growth expectations, with consensus forecasts predicting growth in the 15-18% range for MSCI Emerging Markets index EPS after a 2023 “recession”. Pretty solid, although we are somewhat more conservative with an EPS target of +10% in 2024.

Europe – Euro High Yield & CoCos

2023 had a challenging backdrop for European bond investors, especially at the beginning of the year with the Credit Suisse crisis. For this year, our view on Europe in general remains cautious, as both the expected rate cuts from the ECB, as well as the stronger growth argument that tightening has already filtered through, do not convince us. Hence we do not reiterate our preference for European equity this year. However, we are reasonably comfortable favouring high yield debt, as a proxy for equity. Looking at fundamentals, balance sheets are still healthy, in fact, the EU HY segment ended 2023 with a default rate of 2.54%, up from last year (0.41%) but still at moderate levels. For this year, a default rate of 2.5% is expected, i.e. no major changes. The market is already somewhat cautious today, with about 10% of the index trading at a spread of more than e 1,000 bp. But if we analyse the net leverage metrics, the deterioration has been much smaller, closing 1H23 at around 4.7x (see chart), i.e. at pre-pandemic levels. However, this figure is weighted by the outstanding debt of the issuers and, therefore, is biased by the largest borrowers, the median is lower: 3.7x. If we review the drivers of indebtedness, the deterioration is related more to falls in EBITDA than to an increase in debt. Moreover, the average coupon on BB loans is 4.2% (still very low).

From a technicals point of view, it should be noted that the European HY debt market has contracted by almost 15% since 2021, mainly due to €10 bn net in credits that were upgraded to IG. We also believe that, going forward, demand will outstrip supply, given the limited maturities. However, with a weak economy and high interest rates, credit fundamentals are eroding, which should put an end to risings stars (after 3 very good years), and therefore contribute to less favourable technicals. How are we positioned in EU HY? In terms of duration, neutral, in terms of spreads we expect a slight widening of spreads this year, but nothing critical. By credit segment, it is clear that in relative value, “BB” papers are somewhat “rich”, with very tight spreads relative to BBB. Meanwhile, in the single B’s, the outlook is more benign, since, despite the compression, as seen in the chart, the spread has returned to average levels. We also see some opportunities in the “CCC” segment, but with a “credit picking” approach without any broad allocation. Some names we follow within EU HY are: ZIGGO, ARDAGH and ALTICE.

Gladstone Associates Provident Group

For more information:

SUBSCRIBE TO OUR WEEKLY REPORTS CHANNEL: