Weekly Report 2024 – Gladstone Associates Provident, Controlled Disinflation, Rumours of Cuts and Market Analysis

Gladstone Associates Provident is pleased to present its weekly analysis of the global financial markets. In this report, we provide a detailed overview of the major events that have affected the markets over the past week:

Controlled disinflation:

Last week, in both the US and the Eurozone, Gladstone Associates Provident identified signs of controlled disinflation. This has generated a rally in global bond and equity markets, marking a historic month for US bonds and highlighting expectations of rate cuts by the Federal Reserve and ECB.

Prospects for Rate Cuts in 2024:

In this analysis, we explore the possible motivations behind next year’s expected rate cuts. Will they respond to near completion of disinflation and solid GDP, or will they be a preemptive measure in the face of a possible recession? Gladstone Associates Provident weighs up the scenarios and assesses their impact on bond and equity markets.

“Finally, in terms of market performance, from a sectoral point of view, almost all sectors recorded gains during the week, especially real estate (+4.64%), materials (+2.56%) and industrials (+2.14%). Finally, stock indices ended Friday with gains in the US (S&P 500 +0.59%, Dow Jones +0.82%, Nasdaq +0.55%). In Europe, the end of the week was more positive (Euro Stoxx 50 +0.82%). In Asia, negative (Hang Seng -1.25%, Nikkei -0.17%)”

“Gladstone Associates Provident examines a variety of sectors, highlighting the highlights of the past week, such as real estate, materials and industrials. In addition, detailed analysis of US, European and Asian stock indices is provided.”

International summary:

United States:

In the US, the economy was marked by several key indicators. New home sales unexpectedly fell by 5.6% in October, while the consumer confidence index rose to 102.0 in November, ending three months of decline. New jobless claims came in slightly below expectations at 218k.

Economic growth in the third quarter beat estimates at a solid 5.2%. Fixed investment and government spending accounted for this dynamism. The personal consumption expenditures price index rose 0.2% month-on-month and 3.5% y/y, in line with expectations.

As for manufacturing PMIs, the ISM remained at 46.7 in November, reflecting contractionary conditions, while the S&P Global figures pointed to slightly firmer conditions at 49.4.

Europe:

In November, euro zone inflation eased to 2.4% y-o-y, falling more than expected and away from the consensus of 2.7%. Core inflation also retreated to 3.6% y-o-y, against expectations of 3.9%. The decline was mainly attributed to services, especially volatile components such as air fares, and less volatile goods. Food, alcohol, tobacco and basic goods also contributed to the decline in inflation.

Looking at specific components, energy fell by 11.5% y-o-y, and core goods and basic services also experienced declines. Unemployment remained stable at 6.5%.

In addition, the final manufacturing purchasing manager’s index (PMI) for November was 44.2, up from October (43.1) and reaching its highest level in six months. However, persistent weakness led companies in the sector to intensify job cuts.

China:

This week, China’s economic data disappointed across the board, with both NBS PMIs falling below expectations in November. The manufacturing PMI fell to 49.4, the lowest reading in four months, while the non-manufacturing PMI dropped to 50.2, barely in the expansion zone and marking its lowest level of the year.

Despite this, the week closed on a mixed note, as Caixin rose to 50.7, suggesting a sequential improvement in the sector. Production was the sub-index that increased the most, followed by employment.

Our view – “The Last Dance”

Today finally marks the start of the last month of the year. Against the backdrop of an exceptional November, investor sentiment, while still high, has moderated as it is clear that the main indices are operating at certain overbought levels, at least in the more “technical” aspects. On the fundamental side, inflation, GDP figures, etc. are largely supportive of the softening, and while underlying indicators may show weakness, the overall picture remains solid.

What might be some of the most worrying signs? In principle, the health of the economy depends massively on the solvency of the consumer, in this case the US consumer, who is already depleting his cash reserves, his savings, and is beginning to make up for that deficiency with credit. Indeed, according to figures from Goldman Sachs, card lending continues to grow, increasing by an average of 1.6% in October over September at five major US card lenders, compared to a typical seasonal increase of 0.7%, as tracked by the latest monthly data.

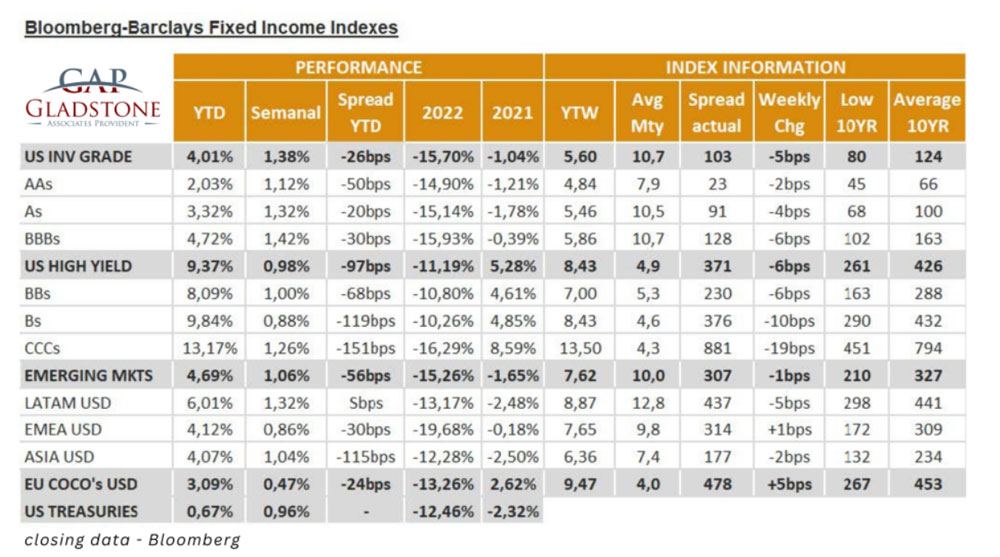

Fixed Income

Interest rates fell across the board, driven by expectations of Fed rate cuts next year. Rates fell in a range of -20/40 basis points, with the 2-, 3- and 5-year maturities showing the steepest moves. Rate futures now anticipate a first cut of -25 basis points by May 2024 and a total of -130 basis points over the year, a fairly aggressive outlook.

Credit markets joined the trend, registering index gains of +1-1.25%, with LATAM bonds such as COLOM, COSTAR and DOMREP, which experienced increases of +2.50/3.50%, outperforming. Meanwhile, Argentinean bonds continued to firm with an increase of +1.00/1.50 in the second post-election week.

In terms of individual performance, PANAMA was one of the laggards due to an unconstitutional ruling on a mining company, protests and bond volatility, although it managed to close positive +$0.25/0.50. ECUA bonds remain under pressure, declining $1.50 after the inauguration of new president Noboa.

On the opportunity side, some more aggressive credits such as BAKIDE, TOTALP and MCBRAC gained 3-5 points. BRASKEM experienced a -2/2.50 drop at the end of the week due to a USD 200 million civil lawsuit, considered by some as a buying opportunity.

In Brazil, we actively participated in the new issue of CSN 8,875 30′, closing in the first half of the week.

Gladstone Associates Provident Group

For more information:

SUBSCRIBE TO OUR WEEKLY REPORTS CHANNEL: